Blog

Types of Competitions There are many competitions in STEM and natural sciences. Typical examples include various Olympiads, AMC, robotics competitions, and programming contests. You probably heard of Science Bowl, Regeneron Science Talent Search, ISEF Regeneron International Science & Engineering Fair, and International Biology Olympiad (IBO). For business competitions, well-known include the Conrad Challenge and the Wharton Global High School Investment Competition. In the humanities, notable competitions include the New York Times Writing Contest and Model United Nations (MUN). Why Are Competitions Popular? A big reason is the strong focus on STEM. A lot of students aim for STEM majors, and that’s where the bulk of academic competitions are. So it naturally leads to more students getting involved in things like math contests, programming challenges, and science fairs. There’s also a bit of a herd mentality at play. For many parents, college admissions can feel confusing and unpredictable. When they see other families diving into competitions, it’s easy to think, “Well, everyone else is doing it , maybe we should too.” What’s Good About Competitions? · They're clear and measurable. Unlike some other extracurriculars, competitions have a built-in scoreboard. A gold medal is better than a silver. it’s easy to understand and explain. Prestigious contests like ISEF or IMO speak for themselves. When families are uncertain about activity planning, competitions often seem like an easier starting point compared to options like research or independent projects. · They show real academic strength. For students applying to STEM or other technical majors, competitions are a great way to demonstrate ability and potential. They help show you’re serious about your interests. What Are the Downsides? · They’re hard. Really hard. Top colleges don’t just want “competition participants”, instead, they notice the winners. And winning at national or international levels is incredibly competitive: only a few students can get to the top every year. Meanwhile, thousands are doing the same contests. That’s a tough playing field. · They take a lot of time. To do well, you can’t just jump in last minute. Many students train and compete for years. Compared to other types of activities, competitions can be a big investment of time with no guaranteed return. That said, if a student enjoys competitions and shows potential, great! But it’s not for everyone. Forcing it rarely works. It’s important to know your strengths and work with them. There are plenty of other ways to stand out, especially in math and science: join a summer program, do academic research, start a club or teach others, work on an independent project, take an intern, etc. The activity itself doesn’t have to be flashy. What matters is that it fits your overall narrative, shows real effort, and helps colleges understand who you are. There’s no such thing as a "perfect activity", just one that makes sense for you. What Do Admissions Officers Look for in Competitions? · The prestige and difficulty level of the competition · What kind of skills you demonstrated (academic, teamwork, communication, creativity) · The time and effort you put in · How you grew through the experience So, How Should You Choose Competitions? · Once you understand how admissions officers evaluate these things, you can work backward: · Go for well-recognized competitions if possible · Pick ones where you can really show your skills and commitment · Choose experiences that help you grow · And realistically, since we all have limited time and resources, here’s how to narrow it down: · Start with competitions that your school supports, or ones where you have access to training or mentorship · Pick contests that match your interests and your style. For example: If you’re applying for computer science, look at math or CS contests. Think about whether you prefer team events or individual ones, timed tests or long-term projects.

What Kind of Students Do Ivy League Schools Want? Each year when I attend national college counseling conferences and speak with admissions officers from top colleges, I find that the most favored students can be summarized as: "Genuinely interesting people generate genuinely interesting achievements." Let me start with one of our students who was admitted to Princeton. She was a physics whiz who had won several major competition medals. Of course, she was very smart, did well academically, loved reading, researching, and thinking—classic traits of most top students. But what I want to emphasize is that people often think these students succeed because they’re naturally gifted, when in fact, it’s more about unparalleled effort. For example, every time we met via video call, she was always in the lab. That was how she spent nearly every single day. The second student was admitted to UPenn. She exemplified another trait that I find in many outstanding students: a clear, unwavering sense of self-awareness and values. Truly knowing yourself doesn't mean saying, "I want to study business because I want to be an entrepreneur" or "I want to study science because I want to be a scientist." It means having seriously thought about questions like “Who am I?” and “What do I really want?” and having a concrete plan. This student came to us two years in advance to start planning, and over that time, I always noticed that she had a strong sense of self-direction and clarity about her goals. The third student was admitted to Columbia. She had been living in a boarding school since middle school, so she was very independent. She had her own opinions and a perfectionist streak—so much so that she often finished her assignments at the very last minute, which made both me and her essay advisor quite frustrated at times. These students had very different personalities—some were outgoing, others introverted—but they all shared a few key qualities: Clear self-awareness Confident and humble Strong self-discipline and action-oriented mindset This self-discipline and ability to act isn’t just about time management. There's a word in English—"grit"—which can be translated as the willingness to sacrifice short-term pleasure for long-term goals. These students were willing to put in the effort and give up temporary fun for something greater, whether their goals were mature or still evolving. I’ve found that these are the qualities all Ivy League schools value most. And of course, these qualities don’t develop overnight, but rather through years of intentional practice. But of course, we can’t require students that much. Afterall they are just high school students and should enjoy their lives. Our job is to advise them from an admission’s perspective and maximize students’ chance to get into top schools. That’s said, let’s talk about what it actually takes to get into an Ivy League school. In short, quite a lot. Let’s start with a quick math problem. Take a mid-tier Ivy League school as an example: the University of Pennsylvania (UPenn). For the Class of 2024, UPenn received 59,465 applications: 4,748 from in-state applicants, 41,407 from out-of-state applicants, and 12,210 from international students. The acceptance numbers were as follows: 419 in-state students (8.8% acceptance rate), 2,651 out-of-state students (6.4%), and 419 international students (3.1%). Additionally, 3,010 students were placed on the waitlist, and only 40 were eventually admitted — that’s a 1.3% acceptance rate from the waitlist. From these numbers, it's clear that test scores alone don’t determine admission decisions: because most applicants have great scores. What really makes the difference are the non-academic factors. Let’s look at them one by one. Rigor of secondary school record This refers to both the difficulty of the courses you took and the overall academic level of your high school. First, did you take the hardest classes available, like honors or advanced courses? Second, is your school a “key school”? Application Essays By now after attending all the webinars and reading articles I have done, I think everyone understands how important the application essay is. If you’re still putting 70% of your effort into test prep and only 30% into your essays, it’s time to reevaluate. The story matters, but your storytelling skills matter even more. Your essay is essentially your autobiography — it should reflect your achievements, activities, personality, strengths, and standout traits. There are a few common mistakes students make when writing their essays: 1. Weak logical flow. We’ve worked with many students who have deep, thoughtful ideas. When talking to us, they can express themselves clearly. But once they start writing, things fall apart. Their English might be great, but the logic is unclear — they skip steps, and their evidence doesn’t actually support their main points. 2. Trying to say too much. Some students want to cram everything they’ve ever done into one essay. The result? It reads like an extended resume, not a personal story. 3. Trying too hard. In an attempt to stand out, some students exaggerate or present themselves in ways that feel fake or disconnected from reality, in one sentence, make themselves not like high school students. 4. Misunderstanding what’s important. Some students highlight things that don’t matter and ignore the details that actually do. 5. Vague praise, no specifics. Some essays sound more like self-assessments — full of compliments but lacking concrete examples or details that bring the story to life. These mistakes aren’t about English skills. The real issue is in the logic and the misunderstanding of what colleges are actually looking for. Recommendation Letters You’ll need two to three recommendation letters: one from your counselor and the rest from your teachers. The most important one is the counselor’s letter because it gives an overall assessment of you as a student. When we help students prepare for recommendations, we always provide a detailed questionnaire to work through together. The answers help teachers write strong, well-rounded letters. Personal Qualities This refers to the key words I mentioned earlier when we discussed different students. Things like leadership, initiative, independence, curiosity, and so on. These traits should come through clearly in your application. Extracurricular Activities We’ve talked a lot about extracurriculars before, so I won’t repeat too much here. But I want to emphasize again: your activities should align with your application theme. Special Talents Again, something we’ve already covered in earlier posts. First-Generation College Students Since the Supreme Court struck down Affirmative Action, being a first-generation college student has become even more important in the admissions process. In-State Residents Even for private schools like UPenn, whether you're an in-state resident can have an impact. Volunteering / Work Experience These also play a role in shaping your application and showing your maturity and initiative. How Scores and Non-Academic Materials Work Together in College Applications Your test scores help determine which schools are within reach for you, but it’s the non-academic parts of your application that will ultimately decide if you get in. These non-academic factors can seem unclear. There’s no one-size-fits-all formula, which leaves many students don’t know how to approach them. That’s why I want to introduce you to a key idea: your application theme. Once you grasp this concept, everything else — your essays, activities, recommendations, and interviews — will fall into place and start making sense. What Is an Application Theme? It’s the main message of your entire application. In simple terms, what kind of person do you want the admissions office to see? This is your “personal brand” or “main selling point” — the story you’re telling with every part of your application, like pieces coming together in a jigsaw puzzle.

Can a 1530 SAT Score Get You into Princeton? Let me share a real case. One of our students scored 1530 on the SAT. Her dream school was Princeton, and she was very worried that her score might hold her back. Do you think she had a chance? In the end, she got accepted. So, test scores are not the most critical factor—your overall competitiveness is. Today we’re talking about early-stage activity planning. If you’re already in Grade 12, this advice may not apply as you’re likely short on time. But for younger students, your biggest advantage is time. Principle 1: The "Winner Takes All" Rule What does "Winner Takes All" mean? Let’s take the example of the world’s three greatest tenors: Pavarotti, Domingo, and Carreras. To the average person, their singing may sound similar, but if you only had one chance to attend a concert, 90% of people would choose Pavarotti because he is the most famous. College admissions work the same way. A real example: a student we had before made to the national finalist in the Chemistry Olympiad but was not admitted to MIT. That’s the “Winner Takes All” rule—you need to be in the top 1% to 5% in your activity. Whether it's Model UN, research, or competitions, the best rule is to be the best. Here are three takeaways from this principle: 1. If you’re in the top 1% to 5% of any field, admissions officers will take notice. 2. The difficulty of an activity matters less than your ranking. For example, winning a national Model UN might be easier than a national violin award, but they have a similar impact. 3. Choose activities that highlight your academic interests, personal qualities, and/or talents. In short, activities should connect with your application theme. Principle 2: Time Management Many students worry about balancing top-tier activities with heavy schoolwork. This is where time management comes in. To save time while maintaining quality: 1. Learn effective note-taking. 2. Preview material and go to class with questions. 3. Focus for 45 minutes, then take a 10-minute break. 4. Put away your phone. 5. Don’t set unrealistic goals. 6. Sleep when you’re tired. Following these can cut your time spent on schoolwork by 40-50%. With time freed up, you can focus on activities that boost your college application. There are three specific strategies in terms of how to allocate your time to plan activities. 1. Block out regular time each week for activities, like every Saturday morning or after school. 2. Build a reading habit. It improves focus, writing, and helps you find long-term interests. Read what you enjoy—travel, tech, history, etc. No need to force yourself to read classics. 3. Join school clubs. They’re the most accessible resources. Expand outside school only when your needs and interests grow, usually around Grade 10. Principle 3: Focus Your Energy To be the best in any field, you need not only time management but also focus. This means not just giving your full attention while doing something, but also narrowing your efforts to just a few things. Why? “Bonus Points from Admissions Officers”: If you're truly exceptional in a field, admissions officers give you extra admiration beyond your achievements. One student competed in physics from elementary school through to international competitions. These accomplishments formed a powerful narrative, earning them this admiration. “Less is More”: Don’t fill your résumé with easily replicable activities. Focused, meaningful achievements are far more impactful. No admissions officer wants to admit a “peacock” student—someone who looks flashy but lacks depth. Principle 4: Innovation Principle Now, what kinds of activities should you do? Many students think being unique is the key. That logic is only partly correct--standing out matters—but it's often misunderstood. Let me explain. First, in fields like STEM, the highest-value competitions are few and widely known. If you want to take the competition path, you can’t avoid these. If you’re doing research, the metrics for evaluating it are similar. It’s like dancing with shackles—you work within a framework. But it doesn’t mean you must do something no one else has ever done. Instead, find a way to be different within the things everyone else is also doing. That said, you can certainly innovate and create something original. For example, we had a student who applied for business started his own company, and student applied for economics conducted field research. But these efforts came after brainstorming with a clear idea and goal, and planed execution. If you're just trying to be different for the sake of it, and only then start looking for ideas or projects, you're putting the cart before the horse.

I will first introduce schools that are generally generous with financial aid, followed by those that are more accessible—schools that are relatively easier to get into and also offer good financial support. First is Yale University. The average grant or scholarship amount is $63,520, and as we discussed previously, grants and scholarships do not need to be repaid. About 52% of students receive them. The average out-of-pocket cost is $18,650. Yale promises to meet 100% of students' demonstrated financial need, and does so without requiring student loans. This includes both need-based and non-need-based aid. Yale waives all costs for families with annual incomes below $75,000. For families earning between $75,000 and $200,000, the required contribution ranges from 1% to 20% of their income. Second is Dartmouth College. The average grant or scholarship amount is $62,290, with 45% of students receiving aid. The average out-of-pocket cost is $19,210. Dartmouth waives all tuition for families earning less than $125,000 and provides loan-free financial aid packages, meaning all aid is in the form of grants or scholarships that don’t require repayment. Third is Harvard University. The average grant or scholarship amount is $61,800, with 56% of students receiving aid. The average out-of-pocket cost is $19,490. Harvard covers all costs for families earning less than $85,000. Families with incomes between $85,000 and $150,000 typically contribute no more than 10% of their annual income. Fourth is Northwestern University. The average grant or scholarship amount is $61,720, with about half of students receiving aid. The average out-of-pocket cost is $22,100. At Northwestern, around 60% of undergraduates receive financial aid. Among families earning less than $120,000 annually, 97% receive assistance. Next is Wellesley College. The average grant or scholarship amount is $61,330, with 59% of students receiving aid. The average out-of-pocket cost is $21,360. Wellesley eliminates student loans for families earning under $100,000 and caps the total family contribution at $28,000. For other students with financial need, aid packages may include loans, but the loan amount is limited to $3,000 in the first year, with a four-year total cap of $15,200. Sixth is Columbia University. The average grant or scholarship amount is $61,060, with 52% of students receiving aid. The average out-of-pocket cost is $22,060. Columbia waives all costs for students from families earning less than $66,000. Seventh is Stanford University. The average grant or scholarship amount is $60,620, with 53% of students receiving aid. The average out-of-pocket cost is $18,280. Stanford uses a need-based assessment model for financial aid, similar to need-aware, focusing resources on those who need it most. For the class of 2026, students receiving aid were awarded over $68,000 in scholarships on average. Families earning under $225,000—more than 95% of them—receive aid. Families earning less than $75,000 receive over $86,000 in scholarships and grants on average. Though these schools are generous, they are also highly competitive in admissions. Are there generous schools that are less difficult to get into? The answer is Yes. Washington University in St. Louis is a private university ranked 21st nationally, located in St. Louis, Missouri. While admission is still competitive, it's somewhat more accessible than the schools above. The average grant or scholarship is $58,190, with 43% of students receiving aid. The average out-of-pocket cost is $23,430. Colby College is a liberal arts college in Maine, ranked 25th nationally. The average grant or scholarship is $61,720, with 41% of students receiving aid. Colby waives tuition for students from families earning less than $75,000. For families earning less than $150,000, the annual parent contribution is capped at $15,000. Colby uses a need-aware admission policy, meaning financial need is considered in admissions decisions. Still, 95% of families earning up to $200,000 qualify for aid, and nearly half of all incoming students receive some form of financial assistance. Haverford College is a liberal arts college located in the suburbs of Philadelphia, ranked 24th nationally. The average grant or scholarship is $58,000, with 45% of students receiving aid. The average out-of-pocket cost is $23,480. Berea College, ranked 40th nationally, is unique in several ways. Since 1892, it has not charged students any tuition. Currently, the total fee is only $726, covering both tuition and fees. Compared to the national average tuition of $51,147, Berea's cost is almost negligible. Colgate University , which may sound like a made-up school due to its similarity to the toothpaste brand, is actually a top-ranked liberal arts college, ranked 22nd nationally. The university is indeed connected to the Colgate family—William Colgate, the founder of the Colgate company, helped establish the school. Located in Hamilton, New York, Colgate offers an average grant or scholarship of $54,650 to 41% of students. The average out-of-pocket cost is $27,070. A few final suggestions: Although public universities often have lower tuition, they tend to offer fewer scholarships. Don’t be intimidated by their high sticker prices. All the schools we’ve covered today are private institutions. Private colleges often provide very generous aid, and most students receive some financial support. A high-ranking school is not necessarily more generous. Choose between need-blind and need-aware schools based on your actual financial situation.

Need-Based vs. Non-Need-Based Need-based scholarships require students to provide evidence of financial need and are awarded based on the student's financial situation. This evidence includes filling out the FAFSA, CSS Profile, and providing tax returns, W-2 forms, etc., to demonstrate that the family's income is insufficient to cover the full costs. The need-based funding is significantly greater than non-need-based funding, because most schools prioritize need-based aid while supplementing with merit-based scholarships to ensure that students do not miss out on education due to their family’s financial situation. Different schools have different income thresholds. For example: Yale University considers families with an annual income below $75,000 eligible for need-based aid. University of Virginia (UVA) sets this threshold at $150,000 annual income. Many schools offer 100% of demonstrated need-based aid but provide very few non-need-based scholarships. Therefore, if your family income exceeds a certain threshold, you may not qualify for need-based aid, but you also might not receive much merit-based aid either. In this case, you can consider private scholarships. These are non-repayable scholarships funded by third-party organizations, such as private foundations or NGOs. However, they often have strict eligibility criteria. You can also consider federal or bank student loans. These must be repaid and often come with interest. Need-Aware vs. Need-Blind Colleges Colleges can be categorized as need-blind or need-aware when considering applicants’ financial situations during the admissions process. 1. Need-Blind Colleges Need-blind schools do not consider a student’s financial situation when making admissions decisions. This means that an applicant’s ability to pay tuition will not negatively impact their chances of being accepted. At first glance, this seems like a great option. But there are drawbacks. Many need-blind schools cannot meet 100% of students’ demonstrated financial needs. For example, a student might require $50,000 in aid but, due to limited funds and a large number of aid recipients, they might only receive $5,000. 2. Need-Aware Colleges Need-aware schools do take a student’s ability to pay into account during the admissions process. While this may seem like a disadvantage, many need-aware colleges commit to fully meeting the demonstrated need of admitted students. In short: Need-blind schools aim to be fair to all applicants but may not fully meet the financial needs of admitted students. Need-aware schools carefully assess financial need but ensure that admitted students receive adequate financial aid. 3. Need Policies for U.S. vs. International Students Some colleges apply different financial aid policies based on citizenship. For example, many schools are 100% need-blind and fully meet need-based aid for U.S. citizens and Green Card holders. However, for international students, these same schools may be need-aware, meaning financial need could influence admission decisions. Now that we’ve covered financial aid categories, let's dive into the application process, starting with the FAFSA FAFSA 1. What is FAFSA? FAFSA stands for Free Application for Federal Student Aid, which is a financial aid program funded by the U.S. federal government. The name itself indicates that it provides government-backed financial assistance to eligible students. 2. Who Can Apply for FAFSA? The following students are eligible to apply: U.S. citizens Green Card holders (permanent residents) Certain eligible non-citizens, including specific categories of I-94 card holders International students generally do not qualify, except in limited cases (such as refugees or asylees). 3. What Does FAFSA Cover? FAFSA funding consists of four main components: Federal Grants. This portion is need-based and does not require repayment, such as Pell Grant, Federal Supplemental Educational Opportunity Grant (FSEOG) Scholarships: Some FAFSA aid comes in the form of scholarships, which may have specific eligibility requirements, such as academic performance, major, or extracurricular achievements. Work-Study Programs: this allows students to earn money by working part-time at approved institutions, either on-campus or off-campus, to help cover educational expenses. Low-Interest Student Loans: these loans are provided by the federal government with lower interest rates compared to private loans. FAFSA Application Process Register an account and fill out the form ( studentaid.gov ). Each school has a different deadline, and my suggestion is to submit it as early as possible. This way, you can receive the results early and compare the financial aid packages once college admission results are released to make a comprehensive decision. CSS Profile The full name is College Scholarship Service, a financial aid program provided by College Board, which is a non-federal aid program. The CSS Profile is much smaller in scale compared to FAFSA, with about 400 colleges participating. Since CSS Profile uses non-federal funds, international students can also apply, but specific eligibility depends on each school (some schools allow international students to apply, while others do not). Families with high financial aid needs should consider choosing schools that accept both FAFSA and CSS Profile. The application opens on October 1st each year. The deadline is no later than the college application deadline (varies by school), Required documents include parents’ tax returns, tax documents from two years prior (e.g., students applying for Fall 2026 need to submit 2024 tax returns). Understanding the Award Letter After submitting the FAFSA and CSS Profile, the next step is waiting for the results. The school will send an award letter, which details the financial aid package you have received, including the types of aid and the amount of money awarded. Once you receive the award letter, you should carefully review the financial aid package and compare offers from different schools. Key Considerations When Reviewing the Award Letter Understand Your Actual Costs The school provides an estimate, but you should calculate your realistic expenses based on personal circumstances, including food, housing, transportation, etc. How to choose an offer Follow this order: Prioritize funds that don't need to be repaid (scholarships, grants). Next, consider earnings (job). Finally, consider borrowed funds (loans). What if you're not satisfied with the result? You can choose to appeal. The letter you receive will tell you how to accept the offer. Typically, you can log into your student account and select to accept the offer. When the semester starts, your aid will be disbursed. First, the school will use the funds to pay for tuition, housing, and other required fees. If there’s any leftover, it will be credited to your student account. Lastly, FAFSA needs to be renewed every year, so it’s important to ensure you meet the conditions, including filing your taxes properly and keep your tax records, and maintaining your grades to meet the school’s requirements and stay in good standing.

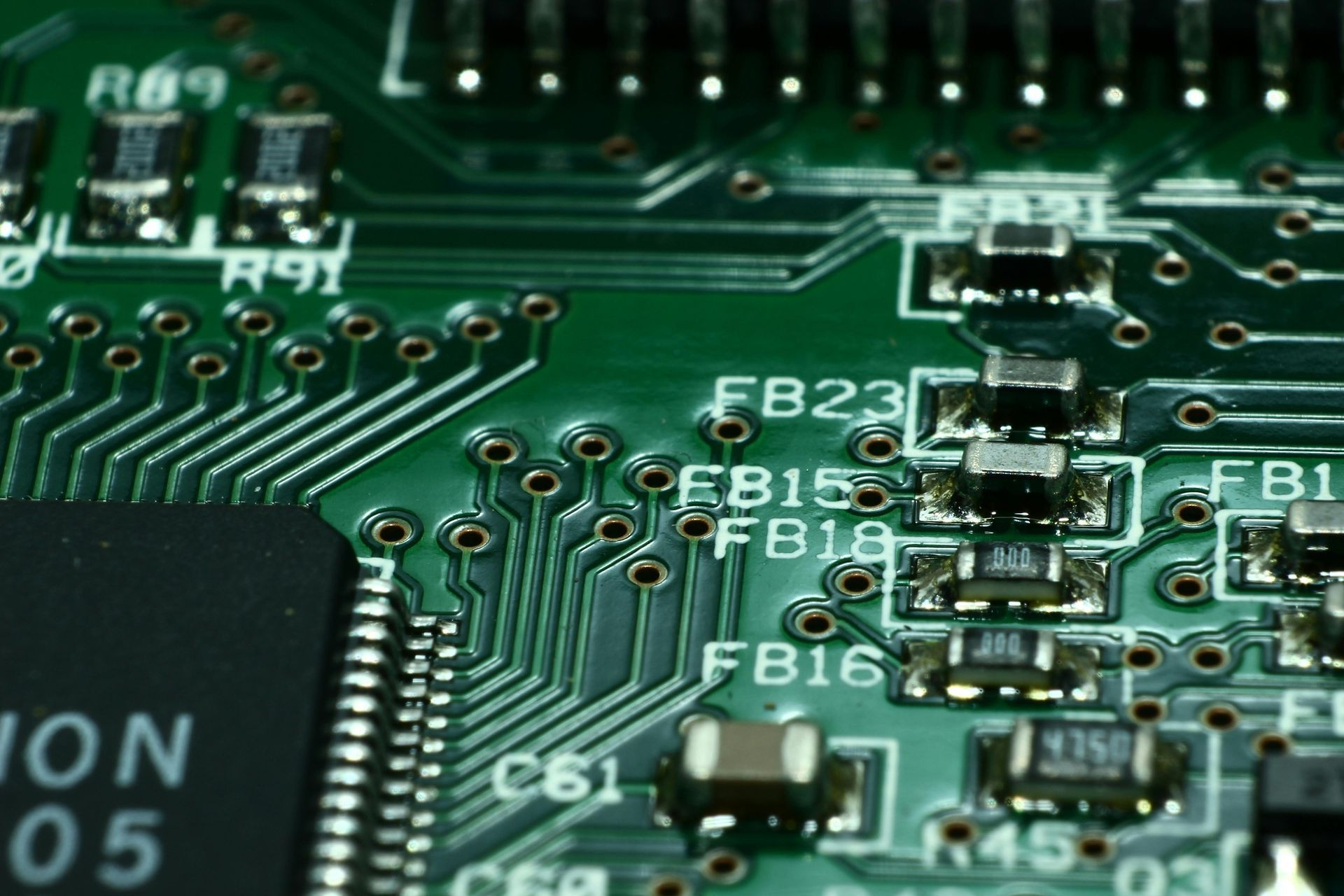

Computer Engineering What is Computer Engineering? Computer engineering focuses on the hardware aspect of computing, such as making computers smaller, faster, and more efficient. Difference Between Computer Engineering (CE) and Computer Science (CS) Computer Science (CS) focuses on software, including courses such as Software Engineering, Artificial Intelligence (AI) & Machine Learning, Database Management, Operating Systems, Cybersecurity. Computer Engineering (CE) focuses on hardware, with courses like Circuit Design, Microprocessors, Signal Processing, Networking Hardware Top Schools for Computer Engineering Renowned universities for Computer Engineering include MIT, Stanford, UC Berkeley. Other strong programs: Purdue University, University of Texas at Austin (UT Austin) Application Requirements To apply for Computer Engineering, students need strong high school academic performance, excellent grades in Math and Physics. Relevant Extracurricular Activities like robotics competitions, Math and physics contests, coding projects and hackathons. Participation in school clubs related to programming or engineering, pre-college summer courses, or science fairs Career Prospects Electronics Companies such as Apple, Intel, NVIDIA. Automotive & Aerospace such as Tesla, General Motors, Boeing. Medical Device Companies such as Siemens, specializing in imaging equipment and medical robots. Financial Services. Telecommunications. Salary Expectations: Entry-level salary range is $70,000–$90,000 per year. Mid-level salary is approximately $140,000 per year Computer Science What is Computer Science (CS)? CS primarily focuses on software development and computational theories. It offers a wide range of specialized fields that address emerging technologies and real-world applications. Popular CS specializations include Artificial Intelligence (AI) and Machine Learning, Data Mining, Software Engineering, Cybersecurity, Human-Computer Interaction, Visual Design, Distributed Systems, Robotics, Natural Language Processing (NLP), Quantum Computing, Cloud Computing, Game Design, and Internet of Things (IoT). Fast-growing fields within CS include Quantum Computing, Augmented Reality (AR) & Virtual Reality (VR), and Artificial Intelligence (AI). Career Prospects To increase employability, students should focus on mastering programming (e.g., Python, Java, C++) and developing a strong understanding of cybersecurity principles. The average starting salary for CS graduates is approximately $90,000 per year. Job opportunities are concentrated in tech hubs such as the San Francisco Bay Area, Texas (Austin, Dallas), New York, and Boston, with emerging tech cities like Denver, Raleigh, and Atlanta also offering many opportunities. Electrical Engineering (EE) Electrical Engineering (EE) covers areas such as circuits, electromagnetics, control systems, signal processing, power systems (strong and weak electricity), communication, and renewable energy systems. Application Requirements For students interested in applying to this major, strong high school performance in mathematics and physics is essential. Recommended extracurricular activities include STEM-related competitions like robotics, programming contests, or science fairs. Additionally, personal projects or portfolios—submitted through platforms like GitHub—can demonstrate technical skills. Internships or volunteer experiences related to the field also significantly enhance competitiveness in applications. Top Schools for Electrical Engineering In addition to well-known universities, schools with strong EE programs include USC, Wisconsin-Madison, Virginia Tech, Texas A&M, and the University of Florida. Career Prospects Employment prospects for Electrical Engineering (EE) graduates span multiple industries, including technology companies that develop microprocessors and memory systems, communication companies like AT&T, Verizon, and Cisco, as well as the electric vehicle and aerospace sectors. The energy industry, with companies such as the State Grid, GE, and Siemens, also employs many EE professionals. Rapidly growing fields include smart grids for improved energy efficiency, the Internet of Things (IoT), hardware-AI integration, electric vehicles and battery technology, as well as robotics and automation. To quickly secure a desirable job in these fields, I recommend acquiring skills such as programming—not limited to computer science but also essential in engineering. Knowledge of hardware description languages, control theory, signal processing, power system analysis, project management, and effective communication is equally important. Starting salaries in the industry range from $70,000 to $85,000, with mid-level positions averaging $120,000. Operations Research (OR) Operations Research (OR) applies analytical tools, mathematical models, and optimization techniques to assist organizations in decision-making and improving efficiency. While it is categorized as an engineering discipline, it primarily uses engineering methods to address business challenges. As a result, many OR graduates find roles in accounting, consulting, or finance. OR offers several subfields; for example, Columbia University allows students to specialize in business analytics, technological entrepreneurship, financial engineering, logistics and supply chain, machine learning, optimization, or stochastic models. Top Schools for Operations Research Renowned universities for OR include Columbia (offering multiple subfields), Cornell (focused on data-driven decision analysis), Princeton (under OR and Financial Engineering), and the University of Michigan at Ann Arbor (under Industrial and Operations Engineering). Northwestern University offers OR as a subfield within industrial engineering, blending it with analytics. Other strong programs include USC and UIUC. Career Prospects OR graduates are well-suited for roles such as data analysts in tech companies, offering a stronger foundation in quantitative analysis than many business analytics graduates. Other opportunities include data analysis, supply chain analysis to optimize processes, financial analysis (as financial analysts or quantitative analysts in the finance sector), and management consulting, where OR backgrounds help streamline processes and inform strategic decisions. Emerging industries include AI-driven optimization, automated transportation, and logistics and supply chain advancements. To secure ideal positions, students should strengthen their foundation in mathematics and statistics, build proficiency in optimization models and programming, and enhance communication skills, especially in data visualization. Many OR concepts are abstract, so the ability to clearly and visually present complex ideas is crucial. Average starting salaries range from $60,000 to $80,000, but mid-level incomes vary significantly by industry. Key employment hubs include the Bay Area (technology) and the East Coast (finance and consulting). Mechanical Engineering The main areas of study in this field include materials mechanics, thermodynamics, fluid mechanics, machine design, industrial processes, control systems, robotics, aerospace engineering, nanotechnology, acoustics, and vibration engineering. Mechanical engineering covers a wide range, from small nano systems to large, complex industrial equipment. It spans the study of sound, fluid flow, and air systems. Top Schools for Mechanical Engineering There are many schools that offer this program, as nearly all research-oriented universities have an engineering school. As long as there is an engineering school, there will be a mechanical engineering program. In addition to the well-known top schools, institutions like UT Austin, UCSD, Virginia Tech, PSU, TAMU, and UF also offer excellent mechanical engineering programs. Job Prospects Career Prospects Because mechanical engineering covers such a broad range of fields, it is relatively easy to find a job. Related industries include automotive, aerospace, industrial manufacturing and design, energy and utilities, robotics and automation, medical devices, and consulting. High-growth areas include additive manufacturing (3D printing), robotics manufacturing, and renewable energy. Familiarity with technologies such as CAD and design software, programming, project management, and control systems and automation makes it easier to find a job. The starting salary is around $80,000. Key job hubs include the Bay Area, Texas, Boston, Detroit, Southern California, and Seattle.

Mathematics-Related Majors: Mathematics, Applied Mathematics, Statistics Mathematics is called the foundation of all disciplines, and there is some truth to this statement. Undergraduate mathematics programs typically offer two degrees options: a Bachelor of Science (BS) and a Bachelor of Arts (BA). The key difference between them is that the BS degree places more emphasis on technical and scientific aspects of mathematics. BS students take more advanced courses in both theoretical and applied mathematics, along with classes related to physics, computer science, and engineering. On the other hand, many liberal arts colleges award a BA degree in mathematics. While BA students also take a substantial number of math courses, they have more flexibility to take classes in the humanities and social sciences. Generally, a BS degree leans more toward quantitative studies. Types of Mathematics Majors Common math-related majors include Mathematics, Statistics, and Applied Mathematics. Here’s a breakdown of the differences: Mathematics focuses on theory and building new mathematical frameworks. It is less concerned with real-world applications. Applied Mathematics combines math with other fields like engineering and physics to solve real-world problems, such as optimizing supply chains, modeling disease transmission, or designing big data algorithms. Statistics is considered a branch of applied math that focuses on collecting, analyzing, and interpreting data. In simple terms, statistics uses data to make decisions. The key difference between mathematics and statistics lies in their relationship to reality: Mathematics does not necessarily require data or real-world context. Statistics is entirely based on real-world data. If the data source is flawed, the statistical model will fail. Moreover, statistics has strong practical applications in various fields. Application Information · There are no additional application requirements for math majors. However, high school math courses are critical. In addition to advanced math, it’s better also to take courses in statistics and physics. · The number of applicants for math majors is generally lower compared to fields like engineering and business. If a student excels in math in high school and does not dislike the subject, applying as a math major could be a good option to getting into a top university. In an ideal world, students can align both their preferred major and college. However, in reality—especially when applying to top schools—students may need to make trade-offs. For example, they might need to prioritize between getting into a top school or pursuing a specific but competitive major like computer science. Top schools for Applied Mathematics : MIT, NYU – NYU was the top-ranked applied math program for a long time. Other strong programs include UCLA, Brown, UT Austin, University of Minnesota (Twin Cities), and UNC Chapel Hill. Top schools for Statistics : Yale, Duke, Northwestern. Other highly ranked schools include UVA, Emory, and UNC Chapel Hill. Career Prospects Many students with an undergraduate degree in math pursue master’s or Ph.D. programs in engineering or business schools. A strong math background is an advantage for careers in actuarial science, accounting, or finance. The median salary for math and statistics jobs is around $104,000. However, pure math or statistics jobs can be harder to find. According to the U.S. Department of Labor, there were only about 30,000 job openings in math and statistics in 2023. In contrast, applied math roles like actuarial science, and big data are much more in demand. For example: Big data jobs : In 2023, there were 200,000 job openings in the U.S., with a growth rate of 36% . Actuarial science : This was covered in our episode on business-related majors. Biology-Related Majors: Biology & Biochemistry Biology covers a broad range of topics, including plants, animals, microorganisms, ecology, evolution, and genetics . Biochemistry is a specialized branch of biology that focuses on the chemical processes within living organisms . It studies proteins, acids, enzymes, DNA, RNA , and other molecules at the molecular level. Biology covers a broad range of subjects, studying all living organisms, including plants, animals, microorganisms, ecology, evolution, and genetics . In contrast, biochemical research operates at the molecular level , concentrating on proteins, acids, enzymes, DNA, RNA , and other molecular structures. Application Information (Biology/Biochemistry) Almost all universities offer biology programs. Top schools for biology include: Stanford , Harvard , MIT , UCLA , UC Berkeley , University of Michigan , UNC Chapel Hill , and UCSF . Career Prospects Biochemistry graduates often work in laboratories , pharmaceutical companies , or medical institutions . Biology graduates may pursue careers in research, but many need to earn a Ph.D. or even postdoctoral experience. Careers in biomedical engineering or bioinformatics tend to have better job prospects compared to traditional biology roles. The median salary for biochemistry-related careers in 2023 was around $107,000 . Chemistry-Related Majors: Chemistry & Materials Science Chemistry involves the study of matter, its properties, and the changes it undergoes. It's a vast field, and organic chemistry is often considered one of the toughest subjects for students. Materials Science is a cross-disciplinary field that combines chemistry, physics, and engineering to study materials and their applications. Applications of materials science include electronics, aerospace, and biotechnology . Examples of materials science innovations include batteries , nanomaterials , and biomaterials such as artificial organs, synthetic skin, and surgical adhesives . Application Information Top schools for chemistry and materials science include: MIT , Stanford , UC Berkeley , UIUC , Georgia Tech , UT Austin , Penn State (PSU) , and University of Florida (UF) . Career Prospects (Chemistry/Materials Science) Materials science graduates often work in industries such as: Electronics and telecommunications Energy Healthcare Aerospace Environmental sustainability Most materials science jobs require only a bachelor's degree , making it a field with a relatively low entry barrier . Environmental Science Due to growing attention to climate change and pollution and waste management, environmental science has become increasingly popular. Key areas within environmental science include: Ecology Climate studies Pollution and waste management Conservation Earth sciences Environmental policy and law Application Information Top schools for environmental science include: University of Florida (UF) UC Berkeley (UCB) University of Michigan (U Mich) UC Santa Barbara (UCSB) UC Davis (UCD) Career Prospects (Environmental Science) Environmental science graduates can work in: Government agencies (such as the EPA ) NGOs Research institutions Consulting firms (as environmental consultants) Private companies (especially in renewable energy and sustainability sectors).

Public Health As the name suggests, Public Health focuses on issues related to community and population health. Core topics include epidemiology, biostatistics, health policy and management, nutrition, environmental and climate health, child psychology and family health, and public health big data. Application Information ● Undergraduate: The application process for undergraduate programs in Public Health is similar to other majors, with no additional specific requirements. ● Master’s Degree (MPH): For graduate studies, applications are typically submitted through the SOPHAS (Schools of Public Health Application Service) system. Some schools, such as UNC, require both SOPHAS and a separate application through their university’s system. Schools Offering Public Health Programs ● Undergraduate Programs: Public Health is not widely offered as an undergraduate major. Recommended schools include: ○ UNC-Chapel Hill ○ University of Michigan ○ Texas A&M ○ UC San Diego ○ UT Austin ○ University of Florida ● Top MPH Programs: ○ Harvard University ○ Johns Hopkins University ○ UNC-Chapel Hill ○ Columbia University ○ UC Berkeley Job Prospects One significant advantage of public health programs is their emphasis on practical experience. For example, UNC requires students to complete a minimum of 200 hours in a practicum, working with government agencies, NGOs, or other partnered organizations (paid or unpaid). Graduates typically work in government, NGOs, or nonprofit organizations. Salaries vary depending on the sector but generally range from $60,000 to $120,000 annually. While not exceptionally high-paying, the field offers fulfilling career paths and opportunities to make a meaningful impact on public well-being. Radiation Therapy Radiation Therapy programs are typically housed within medical schools. Unlike becoming a physician (which requires an MD and years of training), this field has lower barriers to entry, shorter study durations, and less demanding exams. For example, the clinical diagnostic radiation therapy program at the University of Pennsylvania takes three years of study and includes a one-year fellowship. Schools Offering Undergraduate Radiation Therapy Programs Because this is a technical field, there aren’t many schools offering undergraduate degrees in Radiation Therapy. Notable programs include: ● University of Michigan (Flint) ● UNC-Chapel Hill ● University of Missouri-Columbia ● Rutgers University Graduates must obtain certification from the American Registry of Radiologic Technologists (ARRT). Job Prospects Radiation Therapy is an attractive field due to its shorter education timeline, lower application thresholds, and significant career growth opportunities. Programs often provide internship experiences during the course of study. For instance, at the University of Pennsylvania, students complete rotations at hospitals like Penn Medicine and the world-renowned Children's Hospital of Philadelphia (CHOP). It’s not difficult to find a job, with median Salary of $61,370 annually. With its combination of lower entry barriers, solid earning potential, and job demand, Radiation Therapy is an excellent choice for those interested in healthcare without the lengthy commitment of pursuing an MD. Nursing Nursing is a medical-related field with a significant employment gap in the U.S., offering high demand and stable career opportunities. While the job can be physically and emotionally demanding, it is not overwhelmingly so compared to physicians. Additionally, if you are fluent in a second language can be a valuable advantage in the workforce. Schools offering nursing Almost every university in the U.S. offers a nursing program, making it widely accessible. Graduates must obtain relevant certifications, such as Registered Nurse (RN) or Nurse Practitioner (NP) licenses, depending on their specialization. Job Prospects ● Registered Nurse (RN): Median salary is $89,010 annually. ● Nurse Practitioner (NP): Median salary is $124,680 annually. Pre-Med Pre-med is not a major but a track that prepares students to apply to medical school. You can major in anything—biology, engineering, or even non-science disciplines—as long as you fulfill the medical school prerequisites. For example, Johns Hopkins University’s pre-health program explicitly states: "Johns Hopkins University does not have one standard set of classes that will help you fulfill course requirements for medical/health professions school. We recommend students consider the following general guidelines for completing pre-medical/pre-health course requirements." General Pre-Med Course Requirements To meet medical school requirements, students are typically advised to complete the following courses: ● Chemistry: 2 courses in general (inorganic) chemistry with associated labs. ● Organic Chemistry: 2 courses with associated labs. ● Biology: 2 courses with associated labs. ● Biochemistry: 1 course. ● Physics: 2 courses in general physics with associated labs. ● Mathematics and Statistics: 1 course in each. ● English/Writing: 2 courses emphasizing writing or English. ● Social and Behavioral Sciences: 2 courses, such as Introduction to Psychology and Introduction to Sociology. In summary, while technically you only need to take the required courses during your undergraduate years to apply for medical school, the pre-med track o ffers much more than just coursework. What Majors Do Pre-Med Students Choose? Pre-med students can choose any major as long as they fulfill medical school prerequisites. However, the following majors are particularly popular: Biology: Over half of pre-med students major in biology or its subfields since the medical school prerequisites overlap significantly with biology courses. Chemistry and Physics: These are the second most common choices due to their alignment with med school requirements. Psychology, Economics, and Other Social Sciences: About 10% of medical school admits major in social sciences. These students often need to take additional coursework to meet pre-med requirements. Mathematics and Statistics: Although these majors have minimal overlap with med school prerequisites, their students tend to achieve the highest average MCAT scores and GPAs. What is the Value of Pre-Med? Why Is It Popular? Think of pre-med as a one-stop support system for students planning to apply to medical school. Schools with strong pre-med programs provide resources to help students prepare and plan for med school applications effectively. For instance, Johns Hopkins University's pre-health program offers comprehensive support, including guidance on: ● Summer activities ● Study abroad opportunities ● Hospital internships ● Research projects ● Volunteer and community service ● Course selection ● Preparing for standardized tests like the MCAT (Medical College Admission Test) or DAT (Dental Admission Test). Structure of Pre-Med Tracks The pre-med track typically spans four years, aligning with the undergraduate timeline. However, due to the extensive time required for medical school training, many students opt for BS/MD programs, which combine a bachelor's degree and a medical degree into a single accelerated pathway. These programs allow students to complete the pre-med phase in three years. BS/MD Programs BS/MD programs allow students to apply for both their bachelor's and medical degrees simultaneously and complete both at the same institution. Pros Save time: Traditional medical education takes 8 years (4 years of undergrad + 4 years of medical school). BS/MD programs usually allow students to finish in 7 years. Simplified Admissions: Students are admitted into both programs upfront, many programs remov the need to reapply for medical school, especially the requirement of MCAT. Cons Highly Competitive: Admission rates are incredibly low, usually between 1%-5% , even lower than Ivy League acceptance rates. For top programs like Brown’s PLME, Case Western Reserve’s PPSP, Pittsburgh’s GAP, or Baylor 2Baylor, acceptance rates are even smaller. In conclusion, while pre-med is not a major, it offers a structured pathway and valuable resources for students aiming for medical school. The choice of major and whether to pursue a BS/MD program depends on individual goals, academic strengths, and long-term career plans. Dentistry There are fewer dental schools (approximately 70) compared to medical schools (155). Dental schools offer two degrees: DDS (Doctor of Dental Surgery) and DMD (Doctor of Dental Medicine). ● DDS : The traditional dental degree awarded by most dental schools. ● DMD : First introduced by Harvard in 1867 to emphasize the increasing medical applications in dentistry. Despite the different names, there is no practical distinction between DDS and DMD degrees. Application Process Applications are submitted through the ADEA (American Dental Education Association) system. Students must complete the Dental Admission Test (DAT) and meet all prerequisite coursework requirements before applying. ● The average acceptance rate for dental schools is 5%, slightly higher than for medical schools. ● Top programs, like Harvard’s, are highly competitive, admitting only around 35 students per year. Top Dental Schools Highly ranked dental schools include: ● Harvard University ● University of California, San Francisco (UCSF) ● University of Michigan ● University of North Carolina (UNC) ● New York University (NYU) ● University of Pennsylvania (Penn) ● Columbia University ● University of Texas Health Science Center at Houston Job prospects Dentists enjoy strong earning potential with starting salaries ranging from $120,000 to $160,000 annually. Specialists like orthodontists and oral surgeons typically earn even more. Dentistry offers a high-reward career path, combining strong salaries, specialized training, and the opportunity to provide impactful patient care.

Product Design/Integrated Design Programs Product design is a highly popular field today, sitting at the intersection of design and engineering. A prime example is Apple, which excels in this area, dedicating extensive effort to product design, user experience, and interaction design for its devices, such as phones and headsets. Application Information This program requires a portfolio, so applicants must have a foundation in design, drawing, sculpture, or other 2D or 3D design skills. Schools that offer this major include CMU, Georgia Tech, NYU, and Northeastern. Employment Outlook Job prospects in this field are excellent. The starting salary for product design is around $140,000. Human-Computer Interaction (HCI) HCI is an interdisciplinary field combining computer science, design, psychology, linguistics, literature, and communication. The focus of study is primarily on human-computer interaction and user experience (UX). There are numerous real-world applications, such as voice-based interactions like Siri and Alexa, as well as systems like ChatGPT, making HCI a widely applicable major. Application Information Some branches of this field require a portfolio, while other requirements are similar to those for general majors. Schools offering HCI programs include CMU, Georgia Tech, Stanford, University of Washington (Seattle), UCSD, University of Maryland, Cornell, Rensselaer Polytechnic Institute, and Tufts. Employment Outlook Graduates in this field can pursue careers as UX Designers, Front-end Developers, Content Strategists, and Product Managers. The starting salary is typically around $60,000. Computational Biology/Bioinformatics Computational biology or bioinformatics is a branch of biology that integrates significant elements of computer science and statistics. For instance, at Carnegie Mellon, this major falls under the School of Computer Science, while at UPenn, it is part of the biology department. This major requires students to master both statistical methods and computational skills while also meeting the demands of biology, including experimental biology. The most critical aspect is the ability to bridge these two fields. Courses typically include statistics, probability, computer science fundamentals, machine learning, algorithms, data structures, matrices, advanced mathematics, chemistry, biology, biochemistry, cellular biology, and quantitative gene analysis. As you can see, students pursuing this major need strong skills across the sciences, making them versatile problem-solvers. Application Information Schools that offer this undergraduate major include CMU, UPenn, Case Western, JHU, the University of Pittsburgh, Northeastern, the University of Wisconsin-Madison, Rutgers, and others. It’s important to note that interdisciplinary programs like this aren’t limited to top-tier schools—many mid-tier universities also offer excellent programs in this field. Employment Outlook Graduates often find careers in biotech companies, pharmaceutical companies, hospitals, medical and biological research, and pharmaceutical development. Starting salaries vary depending on the industry.

Economics Introduction Economics studies how humans make the most efficient use of scarce resources to produce and distribute goods and services to meet human needs. The discipline covers various economic activities, principles, and theories, typically divided into "Macroeconomics" and "Microeconomics." For example, economics explores phenomena like supply and demand, inflation, exchange rates, and interest rates, focusing on how these factors affect economies. The field tends to be theoretical, and students usually need a solid background in mathematics. Economics can be divided into several branches, including but not limited to macroeconomics, microeconomics, econometrics, and development economics. Each branch delves into different aspects of economic theory and application. Application Process Admissions for economics programs highly emphasize math performance and advanced economics coursework. For instance, the University of Pennsylvania's Economics Department requires students to take AP Macroeconomics and Microeconomics or their equivalent (Econ 0100 and Econ 0200). For IB students, a score of 6 or higher in Higher Level Economics is required. UC Berkeley expects applicants to have completed courses in macroeconomics, microeconomics, calculus, and statistics. If you're aiming for top-ranked universities, having a strong foundation in high school math, statistics, and economics courses is essential. Economics is also a popular major, often chosen by students who want to apply to business schools but shift to economics due to intense competition in business programs. Most economics programs do not offer a master's degree—only undergraduate and PhD options—highlighting the theoretical nature of the subject. Job Prospects Graduates in economics can pursue careers in finance, as investment analysts or market researchers, or work in consulting firms, particularly in management consulting roles. Additionally, they may find opportunities in NGOs and international organizations like the World Bank or the International Monetary Fund, as well as in government agencies. However, job prospects in economics are closely tied to the prestige of the school; graduates from top universities tend to have better job opportunities, while those from lower-ranked schools may face more challenges. Education Education as a field doesn’t equal to traditional teacher training. It has various subfields, such as Educational Statistics, Educational Policy and Management, Early Childhood Education, Special Education, Educational Psychology, and Educational Technology. These subfields vary in terms of job prospects, with some being easier to find employment in than others, which we will explore further. Application Process Generally, education is considered a relatively easy field to apply for. There are no specific or highly specialized admission requirements beyond those of the university’s general application criteria. Job Prospects For those studying teacher education (teacher training), it’s not difficult to find a job, as there is currently a significant shortage of teachers. But, we all know that salaries for teaching positions aren’t high. On the other hand, certain education subfields offer better job prospects and salaries, such as Educational Statistics and Educational Psychology. For example, the starting salary for educational psychologists is around $66,000. In summary, while teaching positions are in high demand but offer lower pay, certain specialized areas in education provide both solid employment opportunities and competitive salaries. Communication Communication has several branches. There is journalism (in some schools, journalism is a separate major), media or mass communication, and interdisciplinary fields that intersect with advertising and public relations. Application Requirements Communication requires strong language skills, especially in writing. For instance, Northwestern’s media program has a minimum TOEFL score requirement of 100 for foreign applicants and does not accept super scoring. Employment Outlook Traditional media fields, such as newspapers, magazines, and broadcast television, are more challenging for job seekers. However, advertising and public relations offer better prospects. The entry-level salary in the advertising industry is around $60,000, which is the national average. Salaries on the East Coast tend to be higher. Political Science Subfields of Political science usually include political theory (starting with Greek philosophy and government), American politics, comparative politics, public policy, and international relations. Application Information Political Science requires extensive reading and writing. So, it can be challenging if you don’t like to read and write a lot of materials in short period of time. Admissions will pay close attention to grades in social studies courses, especially those related to American government and history. Employment Outlook Political science provides good job prospects, which might surprise some people. Many political science graduates go on to law school, as the major is a natural pathway, like how biology majors often go to medical school. In terms of employment, many graduates work in government as civil servants, while others find roles in NGOs and think tanks. There’s also a good number of graduates pursue careers in lobbying and campaign management, such as campaign managers.